AI Agent & LangGraph Hackathon

Hack the Future, One Agent at a Time.

150+

HACKATHON PARTICIPANTS

15

SOLUTIONS BUILT

🏆 Announcing the Winning Project

After an intense competition featuring numerous innovative solutions, we are thrilled to present the winning project. The following sections provide a deep dive into the project's background, its groundbreaking technical architecture, and its significant application value.

Enterprise Market Value Forecasting System Based on Augmented Reflexion-Agent

Background

With the rapid growth of the global economy and the increasing complexity of financial markets, enterprise market value forecasting has become crucial for capital allocation, risk management, and strategic decision-making.

However, traditional forecasting approaches often:

- Over-rely on historical financial data and statistical models;

- Neglect unstructured factors such as macroeconomic changes, supply chain dynamics, policy shifts, and news sentiment;

- Lack dynamic adaptability, leading to limited accuracy and unstable performance.

Thus, there is an urgent need for a new forecasting paradigm that can integrate heterogeneous data sources while providing self-reflection and adaptive optimization capabilities.

Project Overview

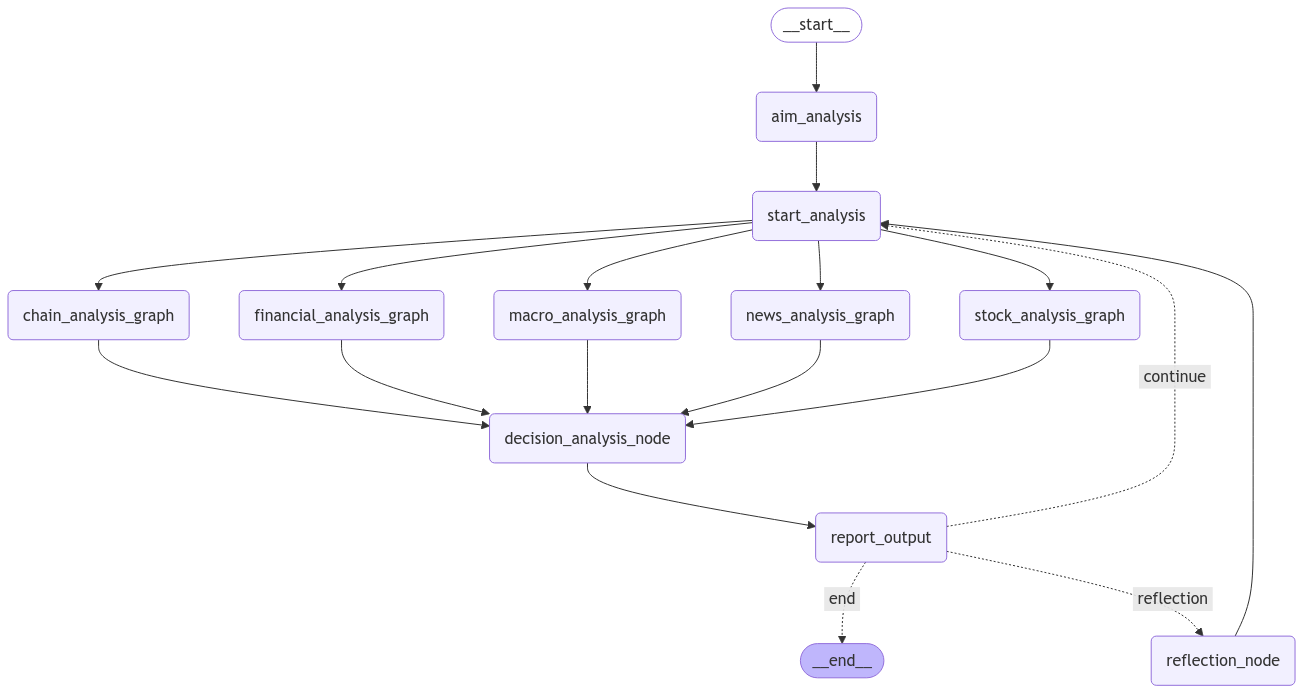

We propose an Enterprise Market Value Forecasting System based on an Augmented Reflexion-Agent and a Retrieval-Augmented Generation (RAG) framework.

The system integrates:

- Structured data: financial statements, market trading data, supply chain knowledge graphs;

- Unstructured data: news sentiment, financial reports (text), and macroeconomic analysis.

By leveraging multimodal data fusion, the system captures key drivers of market value fluctuations, enabling forecasts that are more comprehensive, adaptive, and accurate.

At the core lies the Reflexion mechanism, which allows the agent to:

- Perform self-feedback and strategy adjustment during continuous forecasting;

- Evaluate historical predictions and refine reasoning strategies;

- Establish a closed-loop optimization process, enhancing long-term forecasting stability.

Technical Highlights

1. Automated Data Extraction & Knowledge Construction

- Table parsing and structured data extraction;

- Chunking + multimodal vectorization to build high-quality knowledge bases.

2. Enhanced RAG (Retrieval-Augmented Generation)

- Hybrid retrieval combining sparse and dense vectors;

- Semantic re-ranking to ensure contextual relevance;

- Effectively mitigates "hallucination" in generative models.

3. Reflexion-Agent

- Periodic self-evaluation mechanism;

- Continuous optimization of forecasting strategies;

- Builds a self-evolving predictive loop.

Application Value

- Investment Institutions: Optimize asset allocation and improve returns.

- Enterprise Management: Support strategic planning and risk control.

- Government & Regulators: Assist in macroeconomic regulation and policy-making.